The Basic Principles Of Vancouver Tax Accounting Company

See This Report on Cfo Company Vancouver

Table of Contents5 Simple Techniques For Vancouver Accounting Firm5 Easy Facts About Outsourced Cfo Services ShownUnknown Facts About Pivot Advantage Accounting And Advisory Inc. In VancouverIndicators on Pivot Advantage Accounting And Advisory Inc. In Vancouver You Should KnowWhat Does Outsourced Cfo Services Do?Pivot Advantage Accounting And Advisory Inc. In Vancouver for Beginners

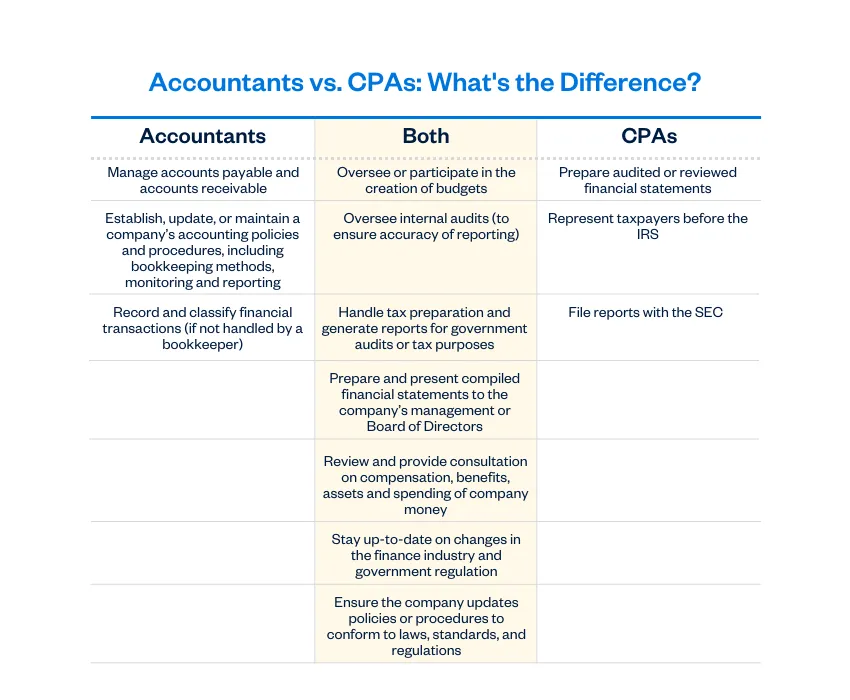

Here are some advantages to hiring an accountant over a bookkeeper: An accountant can give you a comprehensive sight of your organization's economic state, in addition to methods and recommendations for making financial choices. At the same time, accountants are just in charge of taping financial transactions. Accounting professionals are called for to finish more schooling, accreditations and job experience than accountants.

It can be hard to evaluate the ideal time to hire an audit professional or accountant or to establish if you need one whatsoever. While several local business hire an accountant as an expert, you have a number of alternatives for taking care of monetary jobs. For instance, some local business owners do their own bookkeeping on software program their accounting professional recommends or utilizes, giving it to the accountant on a regular, month-to-month or quarterly basis for action.

It might take some history study to discover an ideal bookkeeper because, unlike accountants, they are not called for to hold a professional certification. A solid recommendation from a relied on colleague or years of experience are necessary variables when working with a bookkeeper. Are you still uncertain if you need to work with someone to assist with your books? Right here are three instances that suggest it's time to employ a financial specialist: If your taxes have actually ended up being also complex to take care of by yourself, with several revenue streams, foreign investments, a number of deductions or other considerations, it's time to employ an accountant.

Some Ideas on Cfo Company Vancouver You Should Know

For small services, adept cash management is a crucial aspect of survival as well as development, so it's a good idea to deal with an economic professional from the begin. If you prefer to go it alone, think about beginning with bookkeeping software program as well as maintaining your publications thoroughly as much as date. In this way, should you need to hire a specialist down the line, they will certainly have visibility into the complete monetary moved here history of your organization.

Some resource interviews were performed for a previous version of this post.

Top Guidelines Of Pivot Advantage Accounting And Advisory Inc. In Vancouver

When it pertains to the ins and outs of taxes, audit as well as financing, nevertheless, it never harms to have a seasoned specialist to rely on for advice. An expanding variety of accountants are likewise dealing with points such as capital forecasts, invoicing and also HR. Eventually, a lot of them are handling CFO-like roles.

Little company owners can this contact form anticipate their accountants to aid with: Choosing the company framework that's right for you is very important. It impacts just how much you pay in tax obligations, the documents you require to file and also your personal responsibility. If you're seeking to convert to a various company framework, it could cause tax effects and also other complications.

Also companies that are the very same size as well as market pay really different amounts for bookkeeping. These expenses do not transform into cash money, they are necessary for running your business.

Facts About Small Business Accounting Service In Vancouver Uncovered

The ordinary cost of audit services for small business varies for each one-of-a-kind situation. The typical monthly bookkeeping fees for a tiny organization will climb as you add more services and also the jobs get harder.

You can videotape purchases as well as procedure pay-roll making use of on the internet software. Software program services come in all forms and also dimensions.

The Of Pivot Advantage Accounting And Advisory Inc. In Vancouver

If you're a brand-new company proprietor, don't forget to variable audit costs into your budget. If you're a professional proprietor, it could be time to re-evaluate accountancy costs. Management costs as well as accountant costs aren't the only accountancy expenses. outsourced CFO services. You should likewise think about the results accounting will have on you and tax services your time.

Your capability to lead employees, serve consumers, and also make choices can experience. Your time is additionally beneficial and also should be considered when taking a look at accountancy costs. The moment invested in audit jobs does not produce earnings. The much less time you invest in accounting and also tax obligations, the more time you have to grow your business.

This is not planned as legal suggestions; to find out more, please visit this site..

The Single Strategy To Use For Pivot Advantage Accounting And Advisory Inc. In Vancouver